Everything about Stonewell Bookkeeping

Some Known Facts About Stonewell Bookkeeping.

Table of ContentsThe Facts About Stonewell Bookkeeping UncoveredOur Stonewell Bookkeeping IdeasSome Of Stonewell BookkeepingStonewell Bookkeeping - An OverviewLittle Known Facts About Stonewell Bookkeeping.

Instead of going with a declaring cabinet of different records, billings, and invoices, you can present detailed documents to your accounting professional. After utilizing your bookkeeping to submit your tax obligations, the IRS might select to do an audit.

That funding can come in the type of proprietor's equity, grants, business financings, and investors. Investors need to have an excellent idea of your organization before spending. If you don't have bookkeeping records, financiers can not establish the success or failing of your company. They need updated, exact information. And, that info needs to be conveniently accessible.

The Stonewell Bookkeeping Ideas

This is not intended as legal suggestions; for even more info, please go here..

We addressed, "well, in order to know how much you need to be paying, we need to recognize just how much you're making. What are your revenues like? What is your net income? Are you in any kind of financial debt?" There was a lengthy time out. "Well, I have $179,000 in my account, so I presume my internet revenue (incomes less expenditures) is $18K".

What Does Stonewell Bookkeeping Do?

While it might be that they have $18K in the account (and also that may not hold true), your equilibrium in the financial institution does not necessarily establish your revenue. If someone got a grant or a car loan, those funds are not considered income. And they would certainly not work into your revenue declaration in determining your earnings.

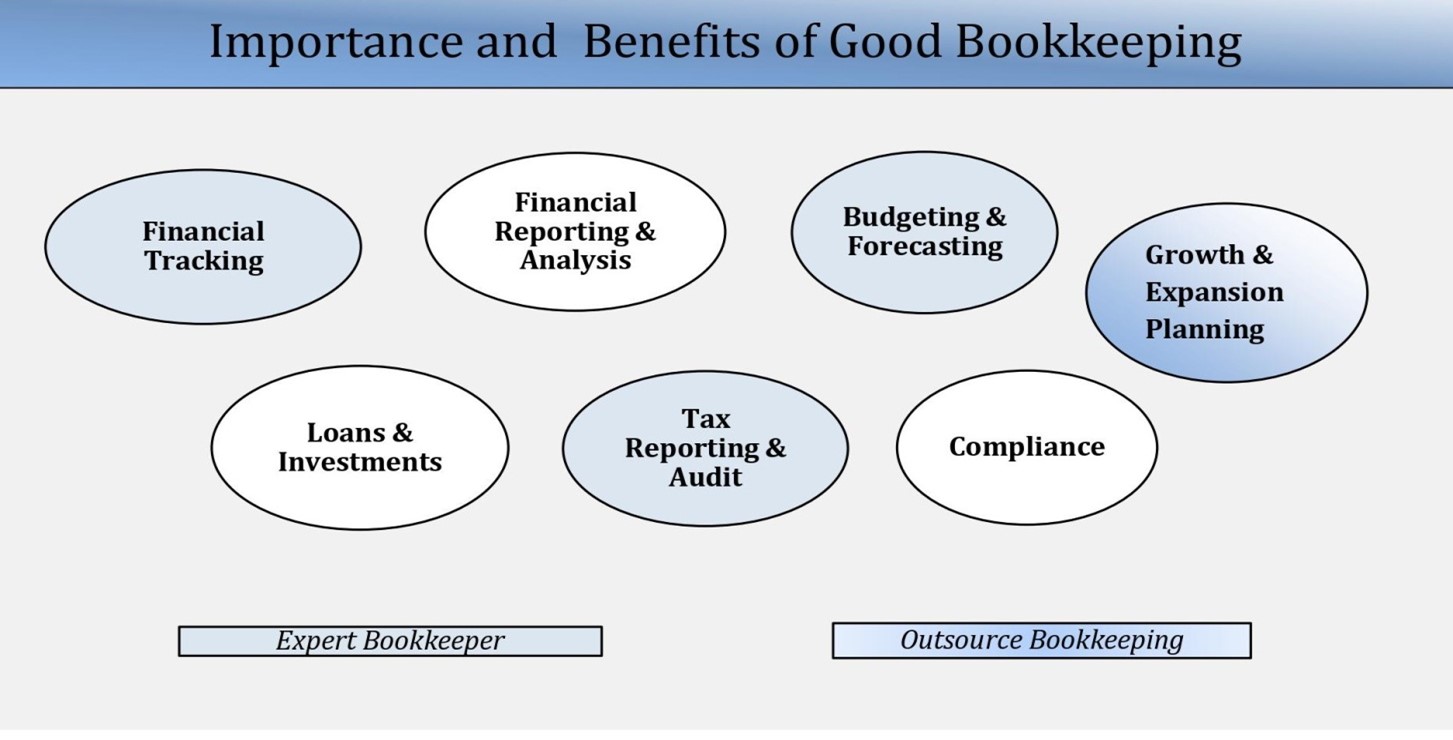

Many points that you believe are expenses and reductions are in fact neither. An appropriate set of books, and an outsourced bookkeeper that can effectively identify those transactions, will help you recognize what your company is truly making. Accounting is the process of recording, identifying, and organizing a company's monetary deals and tax obligation filings.

A successful business calls for assistance from professionals. With sensible objectives and a qualified accountant, you can conveniently address difficulties and maintain those worries away. We're right here to help. Continue Leichter Bookkeeping Solutions is a skilled CPA company with an interest for bookkeeping and dedication to our clients - business tax filing services (https://penzu.com/p/5be3889060f82eef). We dedicate our energy to guaranteeing you have a solid economic foundation for growth.

The Definitive Guide to Stonewell Bookkeeping

Exact bookkeeping is the backbone of great economic administration in any type of business. It helps track earnings and costs, guaranteeing every transaction is recorded correctly. With excellent bookkeeping, businesses can make much better choices due to the fact that clear monetary documents offer valuable information that can direct method and boost earnings. This details is essential for long-lasting preparation and forecasting.

Exact monetary declarations construct trust with lending institutions and investors, raising your chances of getting the capital you require to grow., services should on a regular basis reconcile their accounts.

They assure on-time repayment of expenses and quick consumer negotiation of invoices. This improves capital and assists to stay clear of late penalties. An accountant will go across bank statements with internal documents at the very least as soon as a month to discover mistakes or incongruities. Called bank reconciliation, this process assures that the monetary records of the business match those of the financial institution.

They keep an eye on current payroll information, deduct taxes, and figure pay scales. Bookkeepers generate fundamental economic records, consisting of: Profit and Loss Statements Reveals earnings, expenses, and internet profit. Balance Sheets Details properties, responsibilities, and equity. Cash Money Circulation Declarations Tracks cash activity in and out of business (https://www.gaiaonline.com/profiles/hirestonewell/50621855/). These records aid local business owner recognize their financial placement and make informed choices.

Stonewell Bookkeeping for Beginners

The best option depends upon your budget plan and company demands. Some little business owners prefer to take care of bookkeeping themselves utilizing software. While this is affordable, it can be time-consuming and prone to errors. Tools like copyright, Xero, and FreshBooks allow entrepreneur to automate bookkeeping jobs. These programs aid with invoicing, financial institution reconciliation, and monetary coverage.